Valsts kanceleja/State Chancellery

It was an honor and privilege to introduce and moderate Q/A with the Prime Minister of Latvia, Krisjanis Karins and the Director General of the Investment and Development Agency (LIAA), Kaspars Rozkalns, late last month in St. Paul, USA. They both joined for a business reception to discuss Latvia's place in Europe and its focused approach to economic development and investment attraction. We have become familiar with Latvia's economic development efforts over the last several years and impressed with the distance traveled by a country that was forced to endure the stagnating effects of a socialist, command economy and an occupying regime that challenged Latvian cultural cohesion. The recent war in Ukraine has highlighted Latvia's importance on the eastern border of NATO and resurfaced their commitment to participating in the overall defense posture around the Baltic Sea. It has also nuanced the challenge for a small country such as Latvia, that is to increase positive visibility for its progress in developing itself as a viable, competitive investment destination. Country risk is no trivial investment consideration, we believe addressing it head on in a positive way is the best strategy. From a geopolitical standpoint, that is what PM Karins in fact did, making the case not just for Latvia alone, but for it as an integral part of the larger, protective blocks of NATO and the EU. That left the outlook for the investment environment, which we believe can be distilled down to two main factors: the possession of a viable set of resources which can generate returns and the mindset and ability to use them.

We have traveled in several of the old Warsaw Pact countries and have been generally impressed by the embrace of free-market capitalism and entrepreneurship as a means to generate real growth. As with any change as fundamental as this, the path is not always smooth and entrenched interests can hinder progress. Latvia is also not alone in wanting to create a "start-up" nation, as this is a common theme amongst numerous countries as well as inside many US states. So this is a competitive business and one where we believe the majority will not achieve their targets. That said, the younger Latvian generation that is reaching 30 years of age was born after and did not grow up during Soviet occupation. Indeed, Riga Business School and the Stockholm School of Economics-Riga were not founded until the USSR was already dissolving. Many graduates of these business schools make up the next wave of leadership in the Latvian business community and seem to us as aggressive, technically capable and focused as in other successful entrepreneurial centers we have visited. Interestingly, some in these countries have seemed somewhat puzzled at what they perceive to be the American tilt toward more collectivized tendencies, even as these Europeans have run straight at free market capitalism. Maybe this is because they and their parents have seen the effects of a centralized, socialist movie and for the most part are thoroughly done watching. Some of these newly (30 years is not that long) independent countries remind us more of the dynamic countries we have visited in Asia such as Taiwan, than other western European economies. We think of it as the distinction between playing offense versus defense and one can tell the difference between a team playing to win and one playing not to lose.

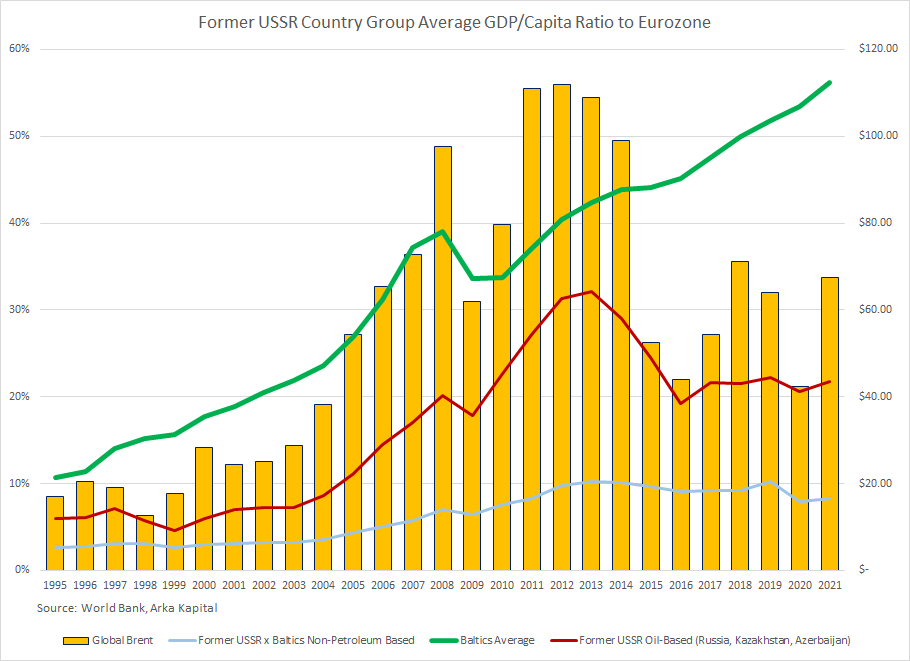

The visibility of the Baltics as an increasingly important NATO border gives an opportunity to highlight just how European and Western facing these countries have been since the dissolution of the USSR and their independence declarations in 1990-91. Consider the chart below, showing the GDP/Capita for different sets of former Soviet republics and each of their relationships to the aggregate Euro Area. While the Baltics exited the Soviet system at ~11% of the Euro Area average, this grew to ~56% by 2021. This compares to a progression of 3% to 8% for the 9 non-oil based former Soviet republics and 6% to 22% for the oil-heavy economies of Russia, Azerbaijan and Kazakhstan. We have included the global price of Brent to show the influence of crude prices to the GDP performance for those countries with heavy exposure to the commodity cycle. The main messages however, are that the Baltics have only widened their starting lead on their former associated republics, remained free of the Dutch disease and seemed to have benefited from their individual incorporation into the European Monetary Union in 2014-15.

How have they done it? Each has taken a slightly different path but they all converge on the basic theme of free markets, a stable, law abiding internal system and shelter within a larger, cooperative trading and currency block (in this case the EU). Indeed, for global investors the risks of currencies and governments must be dealt with as much as those inherent in any discrete opportunity at the corporate level. One measure of the attractiveness of a country as a destination for fruitful investment is the Heritage Foundation's Index of Economic Freedom. Scores are assigned along four dimensions: rule of law, government size, regulatory efficiency and open markets. The combined Baltic score is 76.9 for 2022, with Estonia ranked 7 globally, Lithuania 17 and Latvia 18. The United States sits at number 25 with a score of 72.1. The remaining 12 former Soviet republics average a score of 57.9 with an average ranking of 102. The Baltics have clearly positioned themselves in contrast to the other former Soviet republics and been overall rewarded with higher growth rates, better scoring on economic freedom and diminished corruption perceptions.

While the war in Ukraine has resulted in home-country bias, especially for American investors, we think Latvia deserves a closer look, offering a risk/return profile favorable to the more traditional European investment destinations. The entry into these markets will likely come via private transactions given the limited liquidity offered through the publicly traded vehicles, which should not be an issue given the substantial inflows into private funds in the recent past. We appreciated the team from Latvia providing some depth to their country's value proposition and will be watching how their aggressive, agile and focused strategy drives growth going forward.

dar

Disclaimer

This newsletter is intended for those interested in economics, financial markets, investing and politics. It does not provide investment advice and must not be used for this purpose. Information presented here is believed to be reliable but cannot be guaranteed. No liability can be accepted for any material contained on this website. Material published here is copyright, but can be quoted, provided that attribution is given. By using this website you agree that you use this information at your own risk. In no event will Dean Ramos, CFA, Arka Kapital, LLC or this website be held liable for any direct or indirect trading or investment losses caused by information on this site. The materials on this site are not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the the securities laws of such jurisdiction. Arka Kapital, LLC and Dean Ramos, CFA and this website do not guarantee in any way that there are providing all of the information that may be available. You must do your own due diligence before buying or selling a security. Arkakapital.com, Dean Ramos, CFA and this website must never be relied upon in making investment decisions.

Comments